Watch Market Performance with Olivier Müller

The watch market continues to gain momentum in the first months of 2023 however, the year could become the tough one for the in-between brands, that produce mid-range timepieces.

The positive trend that started in 2022 in the Swiss watch market is most likely to stay, but not for long, says Olivier Muller, founder of LuxeConsult and co-author of the recent Morgan Stanley report on the watch industry.

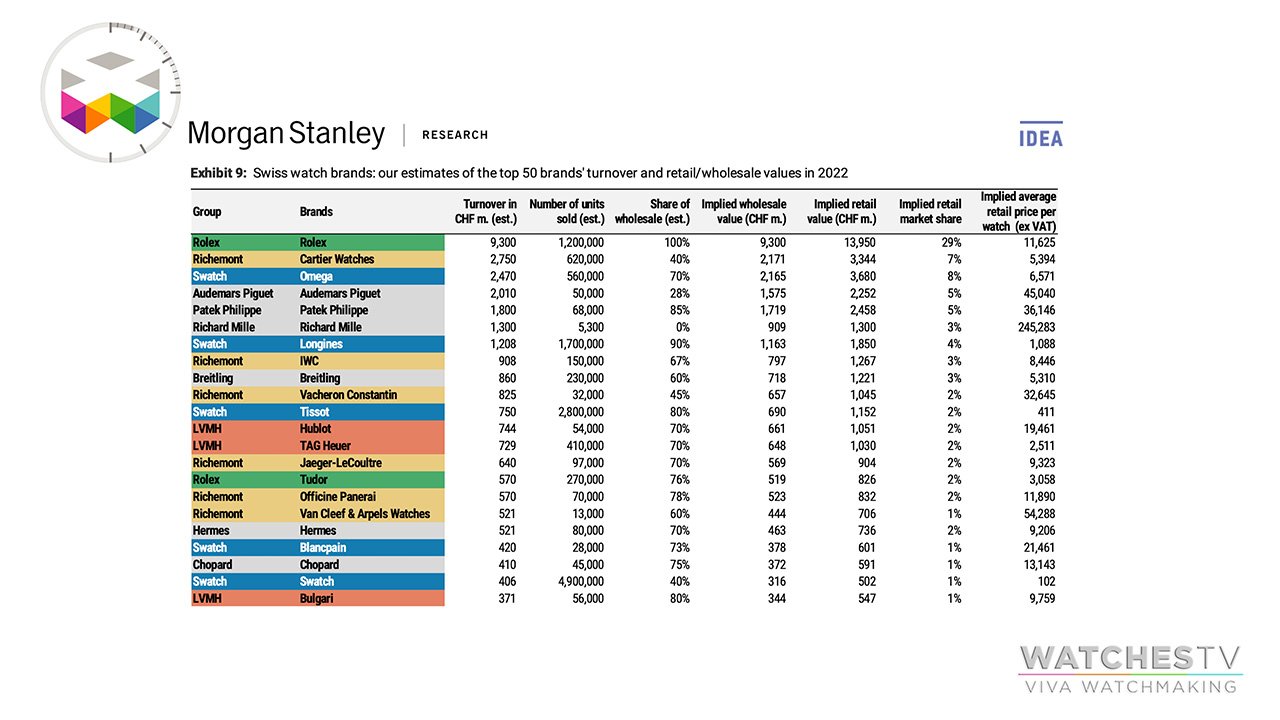

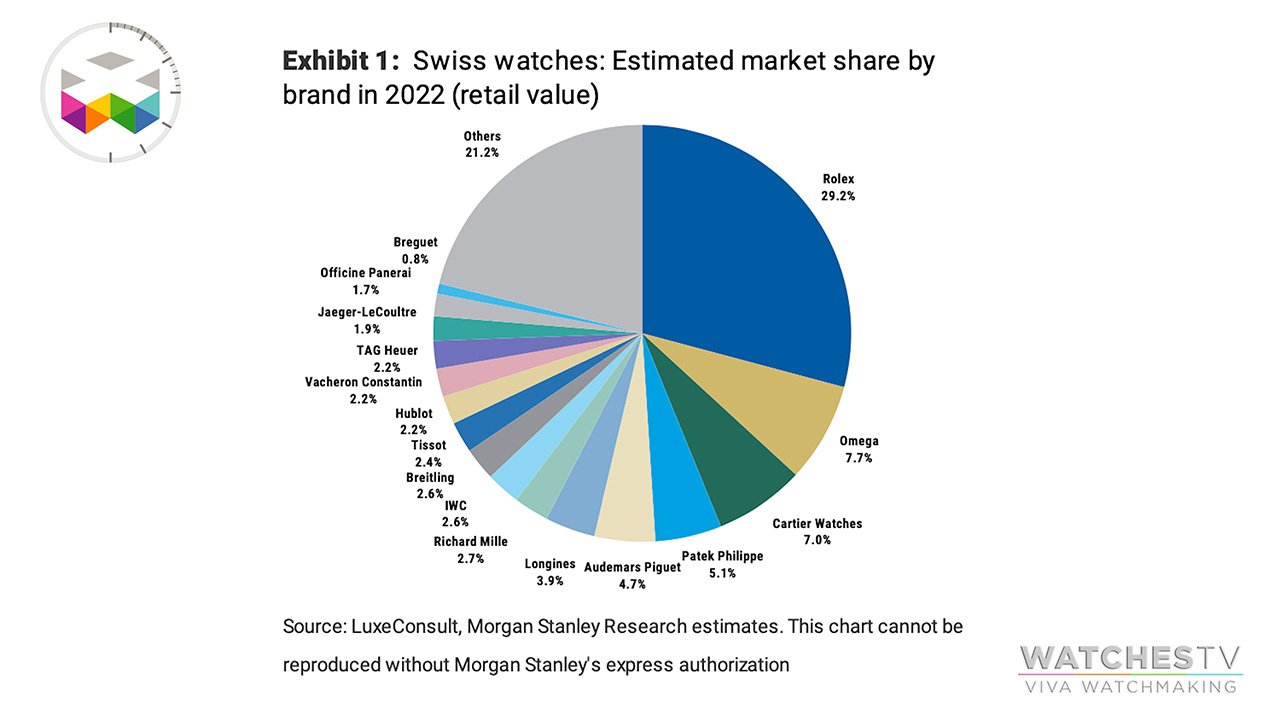

The first months of 2023 have shown steady growth with almost 11% in terms of overall value and almost 5% in volume, the latter mainly pushed by Moonswatch. The Top 10 brands, including Rolex, Cartier, Omega, AP, and Patek will stay intact, despite the rumours about cutting their production. The independent names with their own niche will also keep their place on the market with the possibility of gaining new customers. But the future of the in-between brands that produce mid-range timepieces in big quantities raises concerns.

Muller says he doesn’t see the market crashing in 2023, yet it will not be a high-record year either. The cautious prediction is that the primary market would likely grow between 3-4%, based on the results of the exceptional 2022, with the new brands to secure their places in “The Billionaire’s Club” (IWC, Breitling, Vacheron Constantin). And the secondary watch market might slow down a bit. Manufacturing issues, that carry on this year might have a negative impact on the whole industry, which is counting 5% of the Swiss GDP.

Following the slow restart of China, new export markets will emerge, including Arab countries with Dubai staying the short-term opportunity platform thanks to the Russian customers. This will also force brands to slightly change their marketing strategies.

Listen to the full Podcasts: Spotify / Apple Podcasts

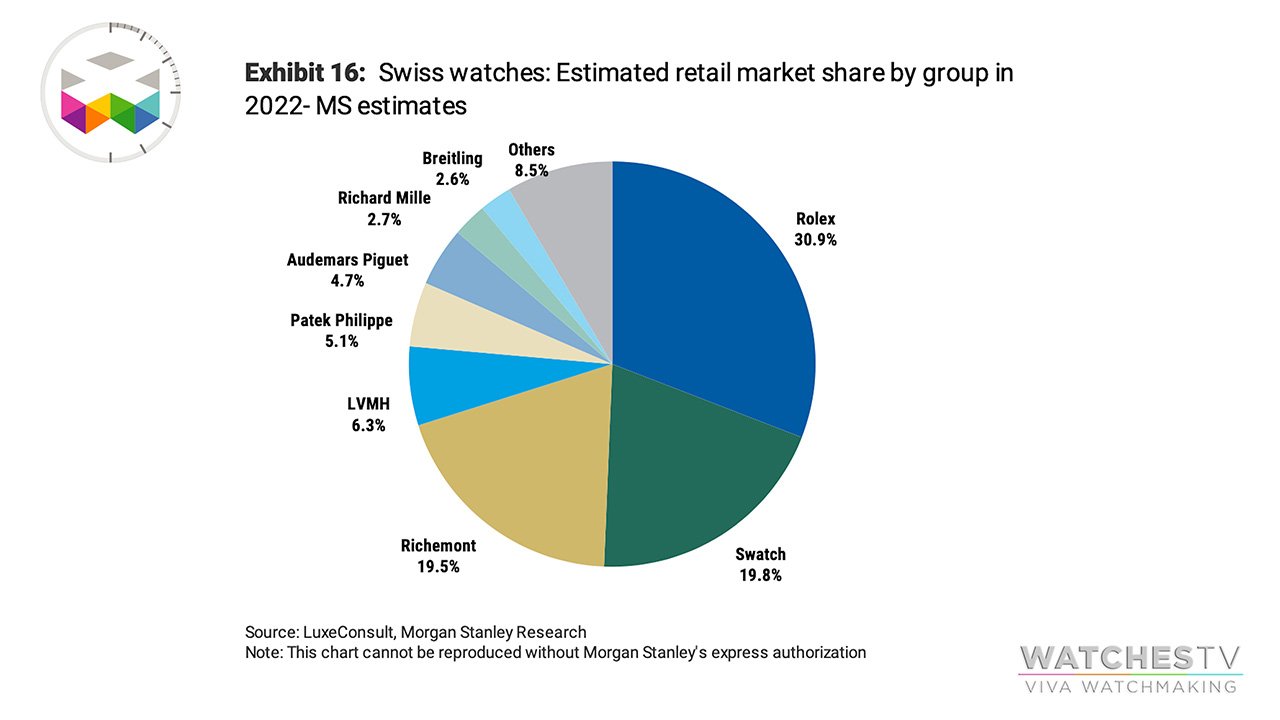

Main Groups performance:

The Swatch Group underperformed in 2022 despite Omega contributing immensely to the growth of the group. Sponsor of the moon exploration programs has a huge potential for the year to come however, Swatch Group should consider diversifying between its 17 brands to show better results in 2023.

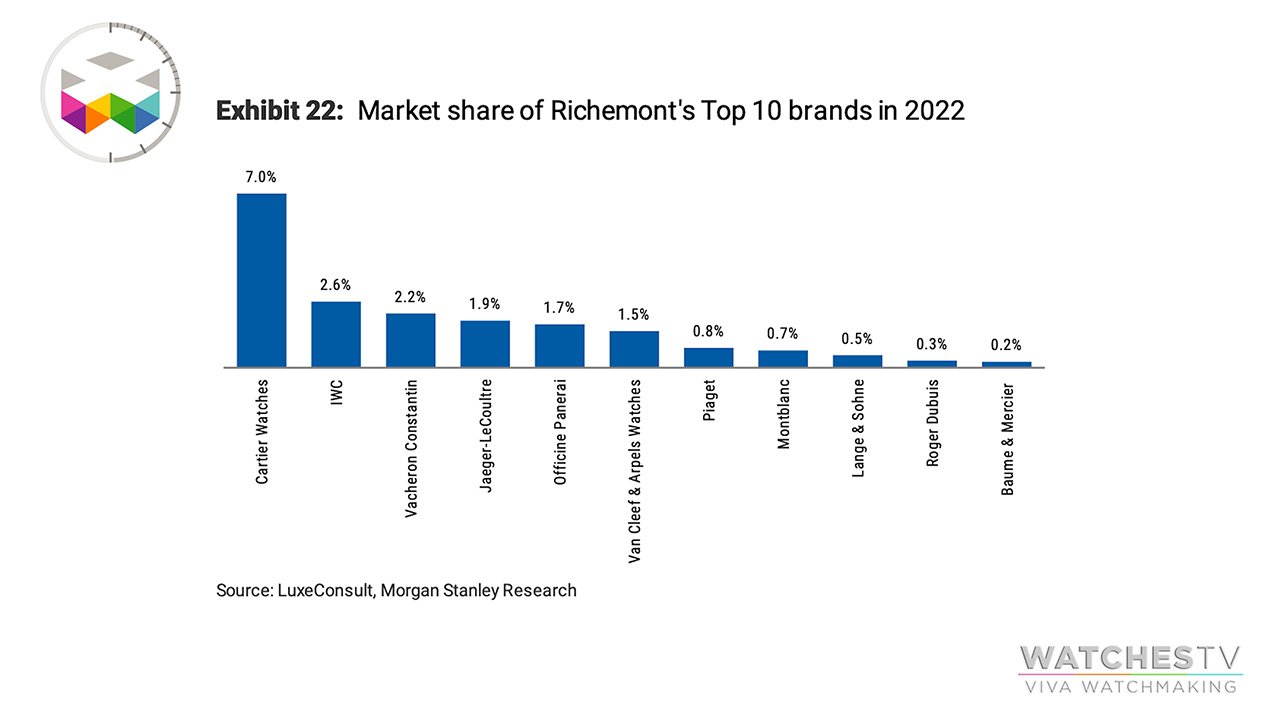

Richemont didn’t perform at the same level as in 2021 and some of its brands should update their long-term strategies. Van Cleef & Arpels is on the rise with exceptional poetic timepieces, but there’s still a complicated and not very positive dynamic recently for Jaeger le-Coultre, questions to Montblanc, Panerai, and Baum & Mercier.

LVMH is on the rise with Hublot being the best-performing brand. Tag Heuer could do more about its historical timepieces instead of turning to smartwatches to get younger customers. Zenith will not become a billionaire brand this year, but there’s a lot of potential thanks to the hard work of Julien Tornare. And Louis Vuitton might soon turn to more luxury pieces and cut the production of its quartz watches.

Top 10 Brands (according to consolidated figures from all markets):

1. Rolex

2. Cartier

3. Omega

4. AP

5. Patek

6. Richard Mille

7. Longines

8. IWC

9. Breitling

10. Vacheron Constantin